By Amanda Hoglund November 9, 2024

Credit card terminals are electronic devices used by businesses to process payments made with credit or debit cards. They play a crucial role in facilitating transactions and ensuring a smooth and secure payment process for both merchants and customers.

In this article, we will explore the different types of credit card terminals, how they work, the components involved, the process of a credit card transaction, security measures, and the benefits and limitations of using credit card terminals.

Types of Credit Card Terminals

There are several types of credit card terminals available in the market, each with its own features and functionalities. The most common types include traditional countertop terminals, wireless terminals, mobile card readers, and virtual terminals.

- Traditional Countertop Terminals: These are the most commonly used credit card terminals and are typically found at the checkout counters of retail stores. They are connected to a phone line or internet connection and have a keypad for entering transaction details.

- Wireless Terminals: These terminals are portable and do not require a physical connection to a phone line or internet. They use wireless technology, such as Bluetooth or Wi-Fi, to process transactions. They are ideal for businesses that require mobility, such as restaurants or food trucks.

- Mobile Card Readers: These are small devices that can be attached to a smartphone or tablet, turning them into a credit card terminal. They are popular among small businesses and individuals who need a cost-effective and portable solution for accepting card payments.

- Virtual Terminals: Virtual terminals are software-based solutions that allow businesses to process credit card payments through a computer or laptop. They are commonly used for online or mail-order businesses where the card is not physically present.

How Do Credit Card Terminals Work?

Credit card terminals work by securely transmitting payment information from the customer’s card to the merchant’s bank for authorization and approval. The process involves several steps, including card swiping or insertion, data encryption, authorization, and settlement.

- Card Swiping or Insertion: The customer swipes their card or inserts it into the terminal, which reads the card’s magnetic stripe or chip. This step captures the cardholder’s account information, including the card number, expiration date, and cardholder name.

- Data Encryption: To ensure the security of the cardholder’s information, credit card terminals use encryption technology to convert the data into a secure format. This prevents unauthorized access or interception of sensitive information during transmission.

- Authorization: Once the card information is encrypted, the terminal sends it to the merchant’s bank or payment processor for authorization. The bank verifies the card details, checks for available funds, and confirms whether the transaction can be approved or declined.

- Settlement: If the transaction is authorized, the terminal sends a request to the bank for settlement. This process involves transferring the funds from the customer’s account to the merchant’s account. Settlement can occur in real-time or may take a few days, depending on the payment processor and the merchant’s agreement.

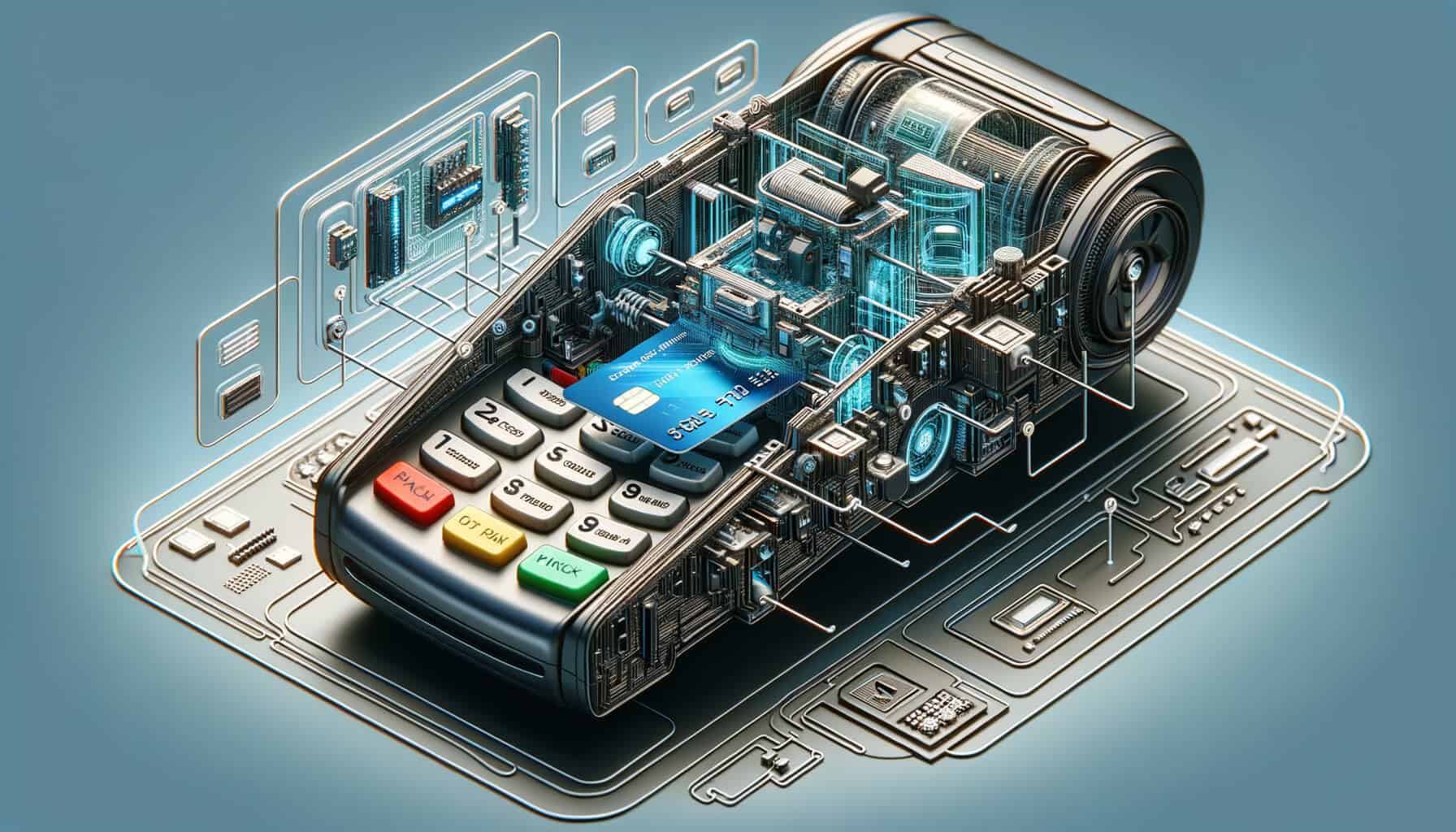

Understanding the Components of a Credit Card Terminal

Credit card terminals consist of several components that work together to process payments efficiently. Understanding these components is essential for merchants to choose the right terminal for their business needs.

- Keypad: The keypad allows the merchant to enter transaction details, such as the purchase amount or customer’s PIN (Personal Identification Number). It also enables the customer to enter their PIN for secure transactions.

- Display Screen: The display screen shows important information to both the merchant and the customer. It typically displays the transaction amount, payment options, and prompts for the customer to enter their PIN or sign for the transaction.

- Card Reader: The card reader is responsible for reading the information stored on the magnetic stripe or chip of the customer’s card. It captures the cardholder’s account details and transfers them to the terminal for processing.

- Connectivity Options: Credit card terminals can be connected to the internet or a phone line for communication with the payment processor or bank. Some terminals also offer wireless connectivity options, such as Bluetooth or Wi-Fi, for added flexibility.

- Receipt Printer: Many credit card terminals come equipped with a built-in receipt printer. This allows the merchant to provide a printed receipt to the customer as proof of the transaction. Some terminals also offer the option to send digital receipts via email or text message.

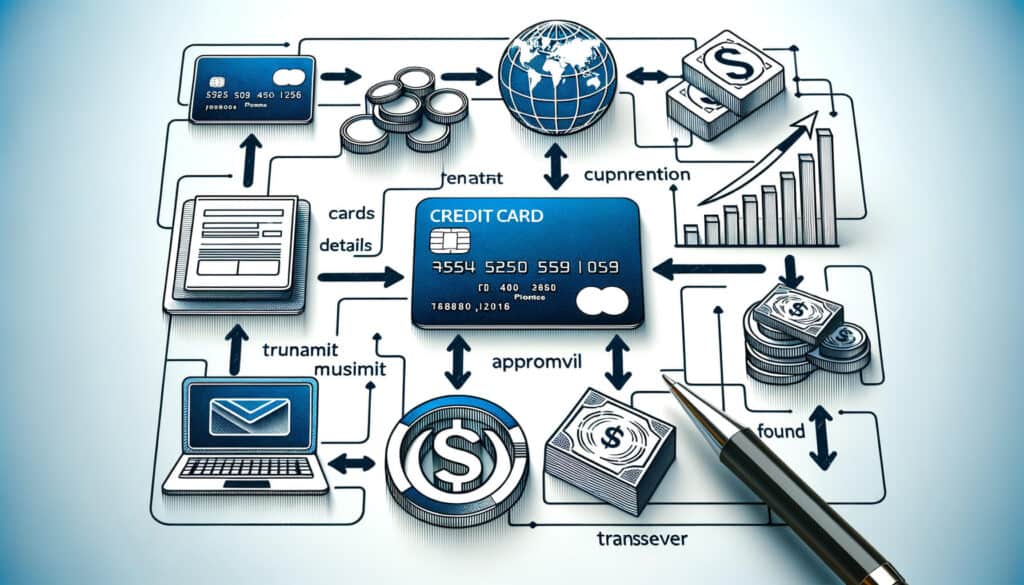

The Process of Credit Card Transaction

The process of a credit card transaction involves several steps, from the moment the customer presents their card to the final settlement of funds. Let’s take a closer look at each step:

- Card Presentation: The customer presents their credit or debit card to the merchant for payment. The card can be swiped, inserted into a chip reader, or tapped on a contactless payment terminal, depending on the type of card and terminal being used.

- Card Verification: The terminal reads the card’s magnetic stripe or chip and captures the necessary information, such as the card number, expiration date, and cardholder name. It may also prompt the customer to enter their PIN for added security.

- Encryption and Transmission: The terminal encrypts the cardholder’s information to protect it from unauthorized access. It then transmits the encrypted data to the payment processor or bank for authorization.

- Authorization Request: The payment processor or bank receives the authorization request from the terminal and verifies the card details. It checks the cardholder’s account for available funds and performs fraud checks to ensure the transaction is legitimate.

- Authorization Response: The payment processor or bank sends an authorization response back to the terminal. This response indicates whether the transaction is approved or declined. If approved, it may also include additional information, such as the authorization code.

- Customer Confirmation: The terminal displays the authorization response on the screen for the merchant and customer to see. If the transaction is approved, the customer may be prompted to sign the receipt or enter their PIN to confirm the purchase.

- Settlement: Once the transaction is authorized, the terminal sends a settlement request to the payment processor or bank. This initiates the transfer of funds from the customer’s account to the merchant’s account. Settlement can occur in real-time or may take a few days, depending on the payment processor and the merchant’s agreement.

Security Measures in Credit Card Terminals

Security is a critical aspect of credit card terminals to protect sensitive cardholder information and prevent fraud. Various security measures are implemented to ensure the integrity and confidentiality of the payment process.

- Encryption: Credit card terminals use encryption technology to convert cardholder data into a secure format during transmission. This ensures that even if the data is intercepted, it cannot be deciphered without the encryption key.

- Tokenization: Tokenization is a process where sensitive cardholder data is replaced with a unique identifier called a token. The token is used for transaction processing, while the actual card data is securely stored in a separate system. This reduces the risk of data breaches as the token has no value to potential attackers.

- EMV Chip Technology: EMV (Europay, Mastercard, and Visa) chip technology is a global standard for secure card transactions. It uses a microchip embedded in the card to store and process data, making it difficult for fraudsters to clone or counterfeit cards.

- PCI DSS Compliance: The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards that all businesses accepting card payments must adhere to. It includes requirements for secure network connections, encryption, access controls, and regular security audits to protect cardholder data.

- Point-to-Point Encryption (P2PE): Point-to-Point Encryption is a security measure that encrypts cardholder data at the point of interaction, such as the credit card terminal. This ensures that the data remains encrypted throughout the entire transaction process, reducing the risk of data breaches.

Benefits and Limitations of Credit Card Terminals

Credit card terminals offer numerous benefits for businesses and customers, but they also have certain limitations. Let’s explore both sides of the coin:

Benefits of Credit Card Terminals

- Increased Sales: Accepting credit and debit cards expands a business’s customer base, as many consumers prefer the convenience and security of card payments. This can lead to increased sales and revenue.

- Faster Transactions: Credit card terminals enable quick and efficient payment processing, reducing checkout times and improving customer satisfaction. This is especially important during peak hours or busy shopping seasons.

- Improved Cash Flow: With credit card terminals, businesses receive payment for transactions directly into their bank accounts. This eliminates the need for manual cash handling and reduces the risk of theft or errors.

- Enhanced Security: Credit card terminals employ various security measures, such as encryption and tokenization, to protect cardholder data. This helps businesses build trust with their customers and reduces the risk of fraud.

- Reporting and Analytics: Many credit card terminals offer reporting and analytics features that provide valuable insights into sales trends, customer behavior, and inventory management. This data can help businesses make informed decisions and optimize their operations.

Limitations of Credit Card Terminals

- Cost: Credit card terminals come with upfront costs, including the purchase or rental of the terminal itself, as well as ongoing fees for payment processing services. These costs can be a burden for small businesses or those with low transaction volumes.

- Connectivity Issues: Credit card terminals rely on a stable internet or phone connection for communication with the payment processor or bank. If the connection is slow or unreliable, it can lead to transaction failures or delays.

- Chargebacks: Chargebacks occur when a customer disputes a transaction and requests a refund from their bank. Merchants may be liable for chargeback fees and may need to provide evidence to prove the validity of the transaction.

- Maintenance and Support: Credit card terminals require regular maintenance and updates to ensure they function properly and remain secure. Businesses may need to invest time and resources in training staff and troubleshooting technical issues.

- Limited Payment Options: While credit card terminals accept most major credit and debit cards, they may not support alternative payment methods, such as mobile wallets or cryptocurrencies. This can limit the payment options available to customers.

Frequently Asked Questions

Q1. What is the difference between a credit card terminal and a payment gateway?

A credit card terminal is a physical device used to process card payments, while a payment gateway is a software application that facilitates online transactions. Credit card terminals are typically used for in-person transactions, while payment gateways are used for e-commerce or online businesses.

Q2. Can credit card terminals accept contactless payments?

Yes, many credit card terminals support contactless payments, allowing customers to make payments by simply tapping their card or mobile device on the terminal. This technology, known as Near Field Communication (NFC), offers a faster and more convenient payment experience.

Q3. Are credit card terminals secure?

Credit card terminals employ various security measures, such as encryption, tokenization, and EMV chip technology, to protect cardholder data. However, it is essential for businesses to choose PCI DSS compliant terminals and follow best practices to ensure the security of transactions.

Q4. Can credit card terminals process refunds?

Yes, credit card terminals can process refunds for customers. The process typically involves entering the refund amount and selecting the appropriate transaction to refund. The funds are then transferred back to the customer’s account.

Q5. Do credit card terminals require a merchant account?

Yes, in most cases, businesses need to have a merchant account to accept credit card payments through a terminal. A merchant account is a type of bank account that allows businesses to receive funds from credit card transactions. It is typically set up with a payment processor or acquiring bank.

Conclusion

Credit card terminals are essential tools for businesses to accept credit and debit card payments. They come in various types, including traditional countertop terminals, wireless terminals, mobile card readers, and virtual terminals, catering to different business needs.

Credit card terminals work by securely transmitting payment information, encrypting data, and obtaining authorization from the cardholder’s bank. They consist of components such as a keypad, display screen, card reader, and connectivity options.

Security measures, such as encryption, tokenization, and EMV chip technology, are implemented to protect cardholder data. Credit card terminals offer benefits such as increased sales, faster transactions, improved cash flow, enhanced security, and reporting capabilities.

However, they also have limitations, including costs, connectivity issues, chargebacks, maintenance requirements, and limited payment options. By understanding the workings and features of credit card terminals, businesses can make informed decisions and provide a seamless payment experience for their customers.